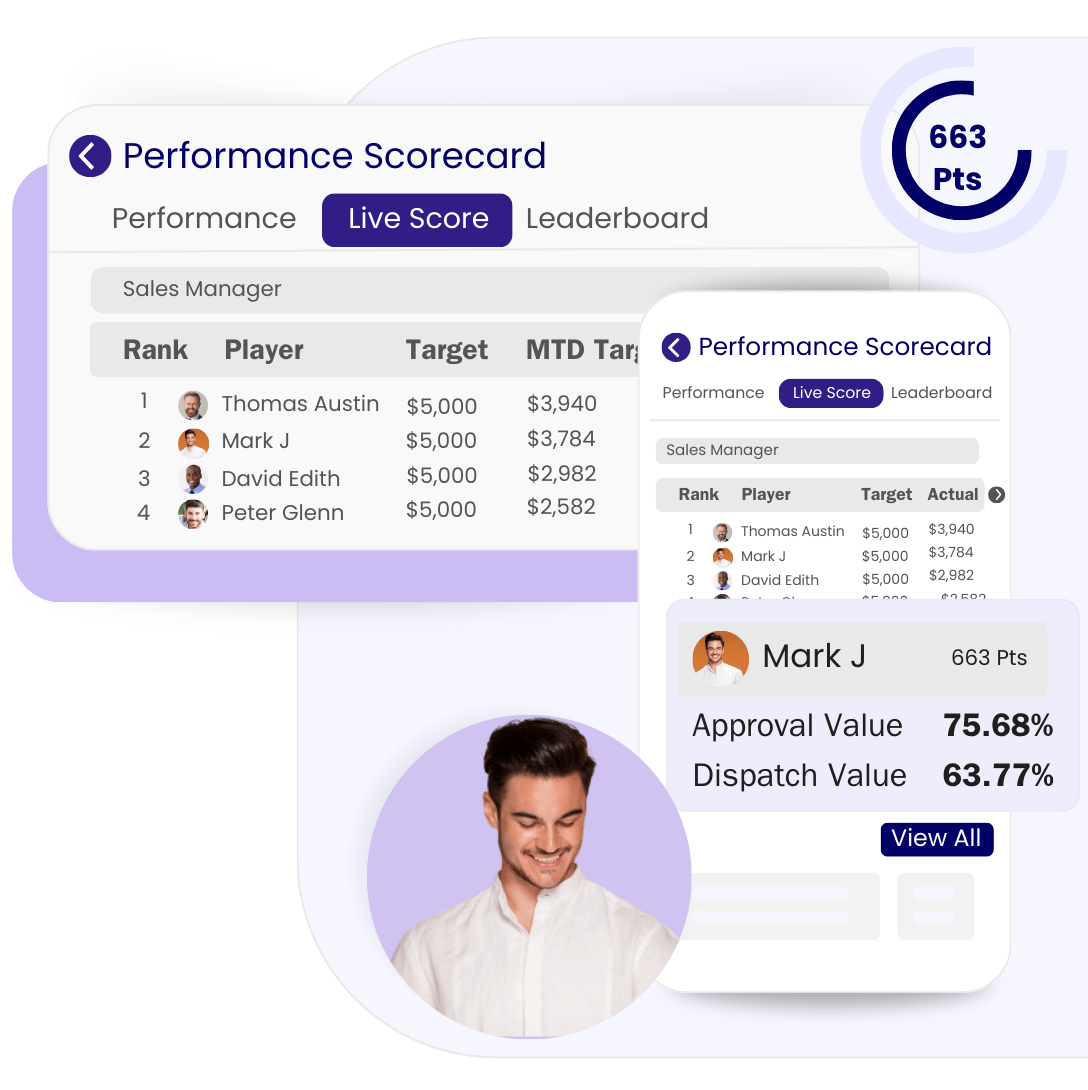

Mark gains clarity: From vague goals to focused plan

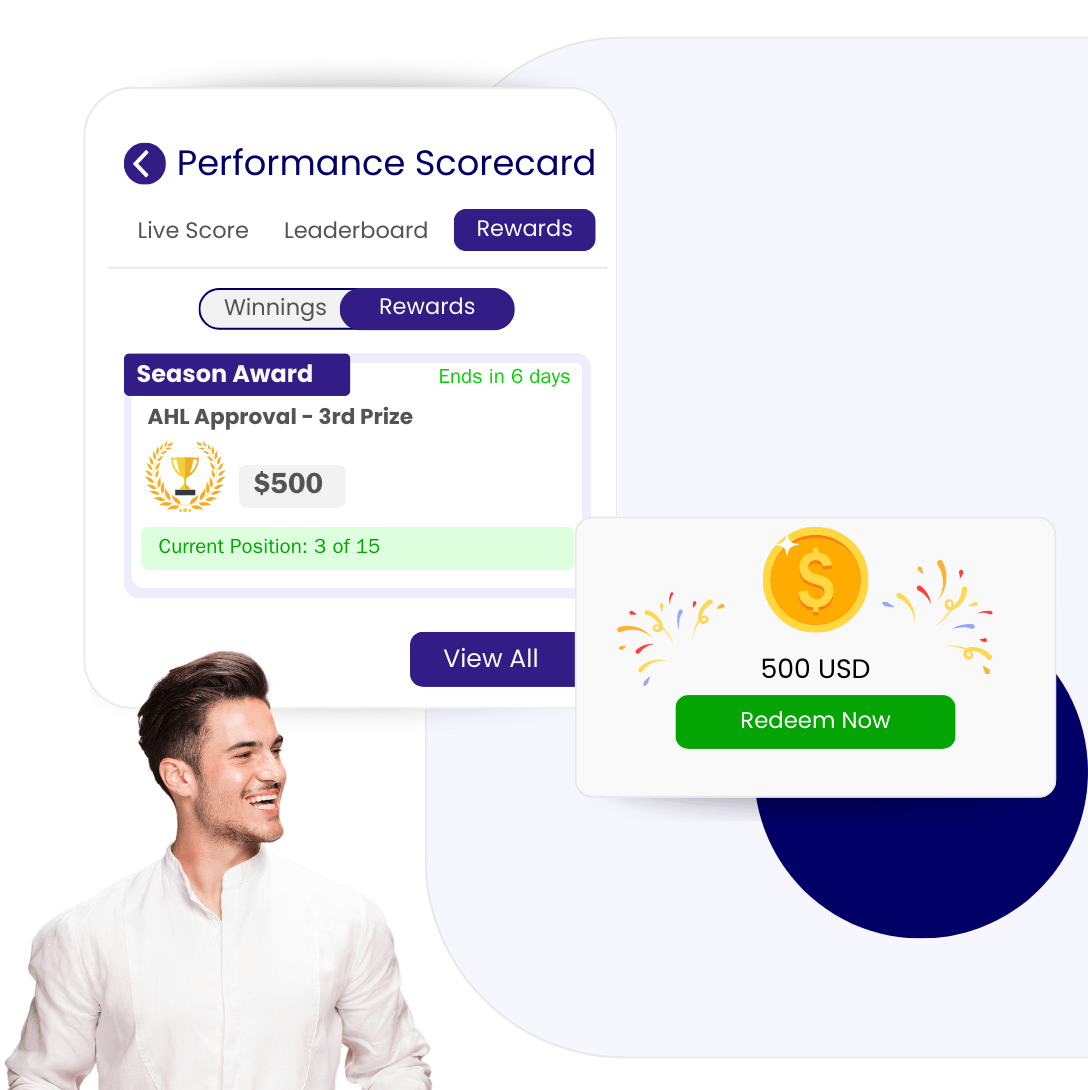

Mark kickstarts his day with a Performance Scorecard, which ensures his performance is aligned with the organizational goals. He can see a simplified and prompt view of what he is supposed to do and where to focus.

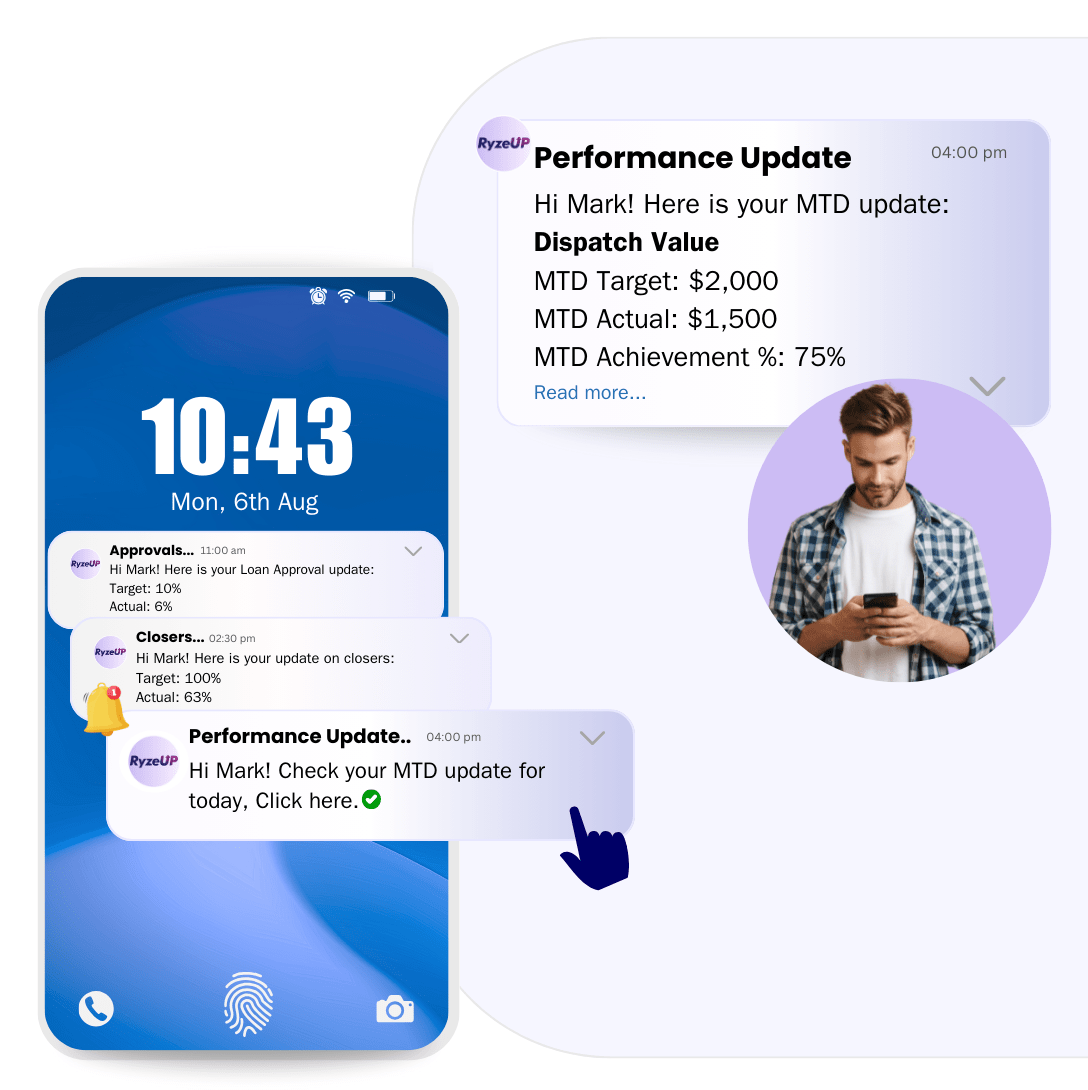

Mark can view a personalized achievement plan, breaking down monthly targets into daily goals, and timely nudge reminders to stay on track. This also simplifies the process for his manager to understand loan approval, disbursal and other patterns within the team.

Mark can view a comprehensive list of KPIs, their respective targets, and his current performance in a single snapshot with RAG (Red, Amber, Green) status. Mark understands that simply completing disbursals is not enough; he must focus on all KPIs to turn red statuses into green and take appropriate actions to meet his target.